The accident management sector is extremely competitive with over 500 accident management companies active across the UK.

With so many companies operating, what are the top players doing to successfully differentiate themselves?

How do the top players maximise vehicle on the road time (VOR), control costs, deliver excellent customer satisfaction, improve safety and deliver all this with motivated and capable staff?

From controlling operational costs to providing excellent customer satisfaction, it’s not always easy to maintain operational efficiency together with strong financial performance and market leading customer service.

For accident management companies to excel in today’s highly competitive market they need to respond rapidly to ever-changing challenges and opportunities.

Timing is a key element to success, time costs money. The total end-to-end cost of an accident is much greater than the cost of paint and bent metal. Time taken from incident to FNOL, roadside attendance time, time to manage the repair, time taken for claims administration and chasing up information, and off road time for the customer, are all costly elements.

Operational planning is also a big issue as accidents by nature are unpredictable, but analytics and pre- and post-incident analysis can help model and plan ahead for operational spikes.

Cost control is a continuous headache, high claims frequency, lack of 3rd party claims control, are all costly but can also in turn lead to higher premiums.

What does good look like?

The top performing accident management companies have a clear strategy underpinned by efficient and effective operating models focussed on customer service, cost control, operational efficiency and continuous staff development.

They also have very high customer satisfaction levels, excellent VOR times, market leading attendance SLA’s, robust risk management processes and data analytics driving insights into better operational planning. They’re equally focused on accident prevention as well as accident management, and are constantly exploring new innovative solutions to incorporate into their business models.

The top tier of successful accident management companies also have ambitious growth targets, and require a leading-edge technology platform to enable them to scale up and continue to deliver excellent accident management service.

What role does technology play?

Parking, for now, the continuous development towards the autonomous vehicle and all the challenges and benefits that it will bring to the sector. Technology is now being used more and more to drive down costs, improve customer satisfaction and drive up safety levels. Technology can now provide instant crash detection, and can immediately predict quantum for vehicle damage and injury, giving the accident management company the ability to dynamically triage the repair or recovery.

Technology can also drive accident prevention through the use of telematics, monitoring driver behaviour and scoring accordingly. Proactively changing driver behaviour improves safety and reduces accidents.

Data analytics can be used to analyse incidents and drive insights into how to avoid future accidents.

How can ICE help?

At ICE InsureTech we provide integrated technologies that connect people, devices and systems within the accident management and insurance sector.

Our accident management system, ICE Claims, has been continually developed over the last 13 years and has been used by 10 leading accident management companies and insurers. We’ve processed over 2 million accident management, windscreen and insurer claims.

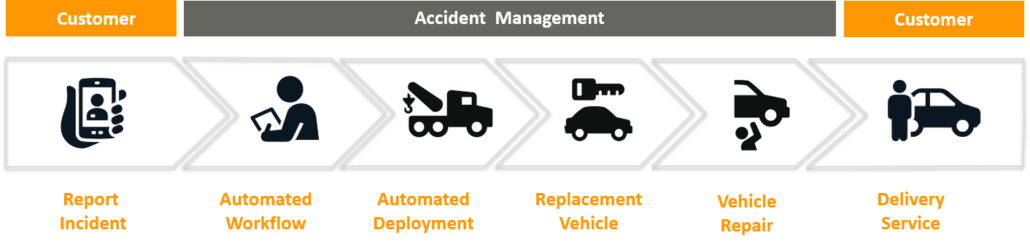

ICE Claims is fully telematics and IoT (Internet of Things) enabled, and our telematics solutions have been tried and tested extensively. We also have the capability for immediate crash detection and triage. On-board devices can dynamically alert the ICE Claims system and kick start the appropriate accident management process. Incidents are immediately reported into our ICE Claims system, allowing accident management companies to quickly control the claim and any 3rd party costs, and deliver excellent customer service.

Our solutions deliver a rapid return on investment, are easy and fast to implement, and can help you to meet the ever-increasing demands of today’s customers.

The advanced ICE technology platform delivers measurable operational benefits including:

- A fully configurable FNOL capability;

- Reducing costs and improving operational efficiencies by automating routine processes, resulting in a more efficient business model;

- Straight-through processing, reducing claims touches and improving the customers’ experience;

- A robust MI capability enabling a single view of the business, with real time reporting and access to unparalleled insight;

- Providing the capability to manage change through configuration, allowing businesses to be agile and responsive to market changes.

Our ICE Claims solution is designed by claims people, for claims people. It’s one of the most implemented claims management systems in the UK and is the most technologically advanced claims system in EMEA, having been accredited with the XCelent Advanced Technology Award.

Want to know more?

Choose a fast, advanced and cost-effective Accident Management solution with ICE InsureTech – Contact ICE InsureTech

More articles

Peppercorn insurance wins first Celent Model Insurer Award with ICE

Peppercorn insurance is ICE’s first client to win the Celent Model Insurer Award for Digital and Emerging Technology. Their well-deserved success has set a new industry standard on how AI can support digital transformation in insurance.

PeppercornAI & ICE InsureTech Announce Partnership

Insurtech PeppercornAI announced their first strategic partnership with ICE InsureTech that will support rapid digital transformation in the insurance industry.

Kindertons launches its big ICE roll-out at the same time as going live on Acturis

Kindertons transforms operations with new launches powered by Acturis & ICE InsureTech, both integral companies in the Acturis Group.