No code configuration with ICE

In today’s fast-paced insurance landscape, agility and self-sufficiency are key to staying ahead. We believe in “No Code, No Limits”, empowering clients to take full control of their products with ease.

The Power of ICE

ICE delivers modular, configurable insurance software for both Policy and Claims

True no-code configuration

Award winning policy and claims software

Rapid speed to market

Product change at the hands of the business user

Manage and launch products in weeks, yourself

Client Case Study

From an idea to a premium of £200 million

The Ticker and ICE InsureTech partnership.

Watch the exclusive Insure TV interview where Richard King, Founder and CEO at Ticker, and Andrew Passfield, CEO at ICE, share how ICE powered Ticker’s launch as a motor telematics start-up. Since 2018, Ticker has seen rapid growth. Expanding its product range with no reliance on ICE for new launches.

Ticker & ICE Project

Key Success Metrics

5 month

£170m

a run rate of circa £170m GWP

4 products

launched to market, no reliance on ICE

1st UBI

product on ICE with pay per mile

Our success stories include

Change today. Lead tomorrow.

Let’s Talk

The time is now to make the change

Transformation

Case Study: Acorn Group

Following that success, the Insurer has scaled significantly, rolling out 13 additional products onto ICE. Throughout this journey, ICE has provided the resilience, automation, and flexibility needed to support their expansion while enabling greater self-sufficiency.

Acorn Group & ICE Project

Key Business Achievements

1.8m

> 50%

Customers use self-serve

14%

Increase in staff productivity

> 55%

Customers are registered

Unlocking the Power of Configuration

Seamless Product Change with ICE

At ICE, configuration is at the core of our platform’s design. Our configurable framework allows clients to tailor workflows to their business model with no reliance on ICE.

ERS, a specialist motor insurer, went live with ICE Policy and ICE Claims as part of a wider legacy transformation, where we helped build their first two private car and fleet products and schemes. After that, they independently developed an additional 38 products.

BROCHURE

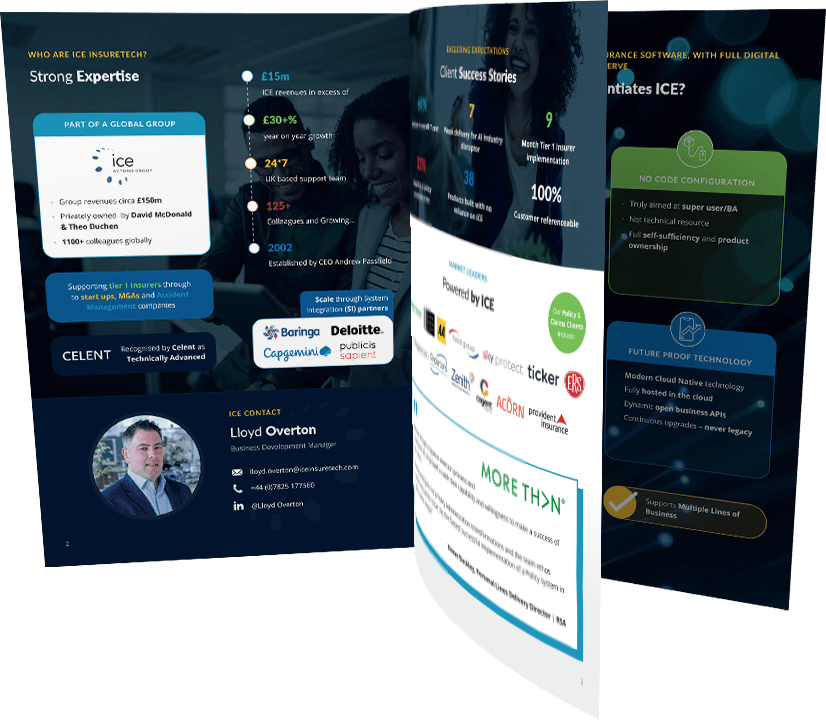

Why ICE InsureTech?

We offer a track record of industry success with our innovative insurance software for personal and commercial lines.

Accelerate your business with our cloud-native platform today. Check out our new brochure for more on the award-winning ICE Insurance Suite.