The insurance industry is evolving at a fast pace in the wake of challenges and opportunities put forward by changing customer demands, compliance requirements, proliferation of digital devices, enhanced connectivity, and others.

ICE InsureTech held an interview with Craig Beattie – Celent’s Senior Insurance Analyst – and created an exclusive report on the Case for a New Modern System.

The report addresses the key insurance technology questions:

- What key trends are driving digital insurance?

- How are these manifesting in insurance?

- What does this mean to the business case?

The Case for a New Modern System

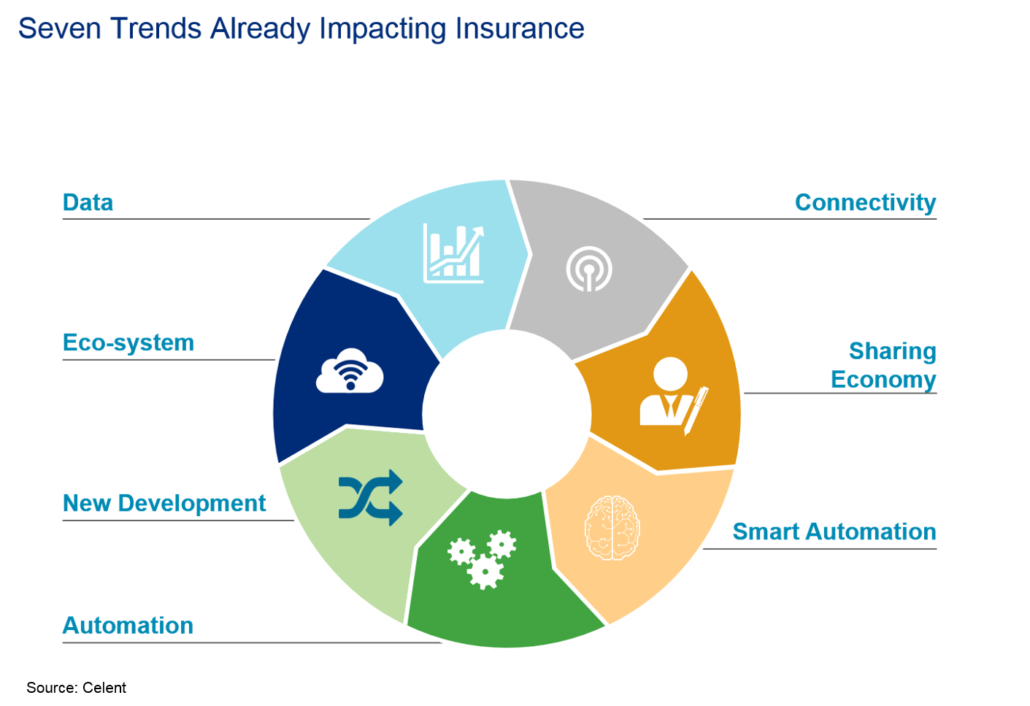

In this report, Celent makes the case that there are seven trends impacting the insurance industry that both enable, and drive the need for, a new modern system at the heart of an insurer. Here we distinguish a new modern system from those that emerged over a decade ago.

These trends are enabling new propositions in the industry such as IoT enabled products, as well as new solutions to old problems with adaptive systems responding to partners and customers changing needs.

These new possibilities and capabilities require some thought to be given to the business case. The benefits covered in a similar report conducted by Celent, nearly 10 years ago (2008) still stand but new sources of benefits are presented making the case for a new modern system.

Celent describes the key differences between a modern system and a new modern system as capabilities in new delivery of the systems as well as the ability to incorporate small or micro-integrations with new services, new automatics techniques and new data.

The ICE Insurance suite has the power of next-generation processing that digitises the way claims and policies are handled. ICE can enable organisations to increase strategic capability, flex propositions to meet market demands and significantly reduce costs.

How ICE InsureTech can help

At ICE, we provide integrated technologies that connect people, devices and systems within the insurance sector.

Our solutions deliver a fast return on investment, are easy to implement and can help you to meet the ever-increasing demands of today’s insurance customers.

For more information, contact ICE InsureTech

More articles

ICE Launches Strategic Payment Integration with PayPal, Now Live with Acorn Group

This milestone follows the successful delivery of a packaged integration of Braintree and PayPal, designed to enhance Acorn’s digital payment capabilities across its multi-brand estate.

Proud Tech Partner: Celebrating Ticker’s New Partnership with RAC Insurance

We’re proud to congratulate our client Ticker on their new exclusive partnership with RAC Insurance, bringing connected motor insurance products to a wider market.

Provident’s Legacy Transformation Story

How did a specialist New Zealand motor insurer transform from legacy bottlenecks to rapid growth, in just 11 months?

Provident Insurance Corporation Limited’s transformation with ICE was not just a technology upgrade, it was a complete operational reset.