Think we only specialise in Motor? Think again.

Take back control today

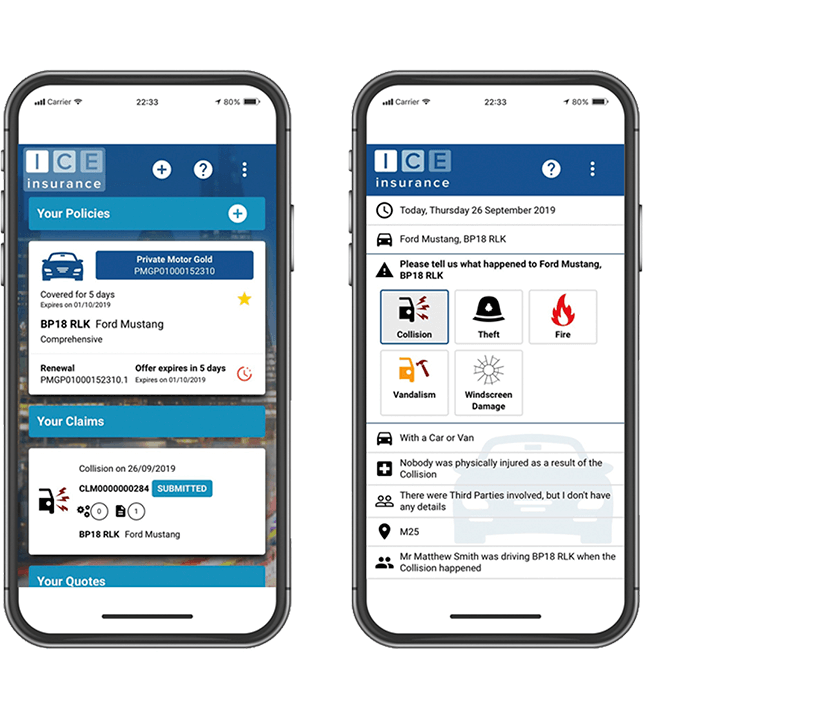

Tech enabled innovation with ICE

- Rapidly launch new insurance products to market and become a digital insurer

- Launch new ideas quickly, you can “test the market” before full launch

- Easily connect with IoT devices, telematics and connected home devices

- Experience dynamic data enrichment, tailored customer journeys and full omni-channel capability

- Advanced ICE ecosystem with accelerators for anti-fraud, document verification, damage assessment and AI / Workflows

Exceeding Expectations

Client Success Statistics

>54%

Customer renewals are now completed online

>90%

Commercial motor new business is now digital

5

Month rapid implementation

>33%

reduction in full policy transaction time

Innovative Technology

Experience with ICE

Easy upgrades

No code configuration

Cutting edge

Client driven roadmap

Innovative Technology

The ICE Platform is

API Enabled

Rating engine agnostic

Cloud Native

Automated

Continuous Achievements

Client Success Stories

Connected Home

John Lewis & Partners

John Lewis & Partners has launched a brand new type of home insurance which offers customers greater flexibility and choice, giving them the opportunity to select the cover they need rather than pay for packages that are not relevant to them.

John Lewis & Partners has launched with ICE Policy as their new Policy Administration System to launch their home insurance partnership.

Tech-led Insurer

MCE

After implementing ICE Claims, MCE Insurance is moving to full AI underwriting following the implementation of ICE Policy enabling them to become a leading tech-led insurer.

ICE Policy delivers a flexible and fully-automated, self-service model to MCE’s customers. Their business processes are streamlined now that their customers can complete the full policy transaction in about a third of the time it would usually take.